Inflation; Anything but Benign

and otherwise known as programmed devaluation of the dollar

Inflation is a rise in prices, which can be translated as the decline of purchasing power over time. The rate at which purchasing power drops can be reflected in the average price increase of a basket of selected goods and services over some period of time. The rise in prices, which is often expressed as a percentage, means that a unit of currency effectively buys less than it did in prior periods.

Introduction

In other words, inflation in prices equals devaluation of the dollar. Supposedly, the Fed’s targeted inflation rate of 2% is necessary to achieve “price stability.” I don’t know about you, but to me “stable” means flat price levels, not persistently increasing prices. Let’s say I weigh 180 lbs and my body weight is increasing 2% per year, every year, for 40 years, ending at 397 lbs; does that constitute “weight stability?” Of course not. And likewise, the 2% inflation target has nothing whatsoever to do with price stability. The assertion is pure propaganda. And, intentionally no doubt, the word “inflation” sounds a lot more benign than devaluation, doesn’t it?

15 Beware of false prophets, which come to you in sheep's clothing, but inwardly they are ravening wolves.

16 Ye shall know them by their fruits. Do men gather grapes of thorns, or figs of thistles?

17 Even so every good tree bringeth forth good fruit; but a corrupt tree bringeth forth evil fruit.

18 A good tree cannot bring forth evil fruit, neither can a corrupt tree bring forth good fruit.

19 Every tree that bringeth not forth good fruit is hewn down, and cast into the fire.

20 Wherefore by their fruits ye shall know them.

Like I’ve done before, I try to put these things in terms that a normal human being can understand, like me for example. So I do this for my own edification, and then share it with you. I’ll admit, I let the assertion that “inflation is theft” bounce off me for a long time. A long, long time. Had I not we would probably be a lot better off than we are today. But, as is often the case, I had to do the math for myself, which I’ve taken a snapshot of just below. Since my “career” started in 1983, this is the perfect time to have a look back at what inflation would have done to dollar savings over the course of 40 years. “Inflation,” especially a measly 2%, sounds benign, which is of course the point, but its impact is insidious, and I’ll argue, pure evil. So, let’s have a look at the fruits of the actual 2.82% average inflation rate we have lived with.

I agree, tables don’t do much for me either. Geri is the table person, I’m more of the charts and graphs visual type of person.

BLUF Bottom Line Up Front

I assumed an inflation rate of 2.82%, which according to InflationTool is the actual average annual inflation rate over the course of the past 40 years. Then, I assumed annual wages of $41,000, which puts it in the lower Middle income class range in 1980, according to Statista.

At the end of our hypothetical 40 years of disciplined saving, our bank balance would show $296,830. Anyone would smile at that I suspect; not a bad nest egg for a person with a lower middle-class income. But there is a problem, the purchasing power, the value of the $296,830, has shrunk to just $194,468, thanks to the insidious effect of inflation, or better said, programmed devaluation of the dollar. In other words, the Federal Reserve, in collaboration with the federal government, has stolen 34.5% of your earnings. Honestly, if that doesn’t piss you off I don’t know what will.

How about this; in my post Whom Shall Ye Serve I wrote,

…our current spending rate stands, <at> 38.21% of GDP, aka Gross Domestic Product. In other words, GDP is a measure of the total production of We the People. GDP is the combined fruits of our labor. And the 38.21% is the percentage of those fruits that we “contribute” to governments at the local, state and federal levels.

So, between taxes on you and futurity, and devaluation of the dollar, you are relieved of 72.7% of the fruits of your labor. If it seems unbelievable, do the math for yourself.

Regardless of the tax take, we can already see, that the fruit of the dollar devaluation “tree,” i.e. programmed inflation, is evil.

And I sincerely believe with you, that banking establishments are more dangerous than standing armies; & that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale.

Thomas Jefferson, in a letter to John Taylor in 1816

Bank-paper must be suppressed, and the circulating medium must be restored to the nation to whom it belongs.

Thomas Jefferson, comment to John Wayles Eppes in 1813

I began this discussion of inflation in my post, Give Me Your Tired, Your Poor. Now who do you think might suffer “disparate impact” from this policy of programmed devaluation of the dollar? From my point of view it is more clear evidence that the powers that be could not care less about the poor. It’s all just words, meaningless words. As the Bible says, “Ye shall know them by their fruits.”

What Does This Mean?

The first thing one would expect, is that savings rates should be depressed. Why save when the Fed is going to take, over time, a very significant portion of your savings? I don’t think people necessarily understand what is happening intellectually, but their gut is telling them that saving is a losing proposition. And rightfully so. The government wants to encourage spending, not saving.

I do think a key takeaway is to only have banked what you absolutely need to have in the bank to sleep at night. We all need some dollars to satisfy dollar obligations in the near-term; short-term liabilities, like the mortgage, utility bills, groceries, etc. In other words, we all need to have some very liquid assets, cash equivalents if you will, that if not dollars can be converted to dollars very quickly.

As I mentioned above, “The government wants to encourage spending, not saving.” Growth of the economy, GDP, is largely dependent on “personal consumption.” If we do not buy a lot that we don’t need, the economy contracts. We can’t have that!, and the Fed encourages spending by discouraging saving.

Another thing that programmed devaluation of the dollar does, is to reduces the real cost of borrowing, a program feature which the government uses to its full advantage. We can do the same; borrow long-term at low fixed rates, and pay off the more valuable borrowed dollars with ever-cheaper future dollars. Having said that, what you buy with those borrowed dollars is key; you want to borrow against real assets that increase in dollar value, appreciate, not things like new cars, or even used cars, which with rare exception will lose value year by year. If you are going to buy a consumable, or something that is going to lose value over time, use cash.

Further Reading, and More To Be Done…

Remember all of that money created from nothing that the feds doled out during Covid, accelerating inflation and devaluation? You know what I’m talking about; it went straight in to guns and ammo, the purchase of which I’m sure the state abhors. Ya gotta love it when a plan comes together. But from the chart I showed in my last post, Another Act of Resistance, apparently I wasn’t alone.

Guns and ammo are examples of real assets that hold or appreciate in value. And what we need to do in general, is to convert dollars earned to real assets as quickly as possible. Every day we hold dollars they become worth less in real purchasing power terms. In short, we want assets that are true stores of value. Of course I will mention precious metals in that regard, which have been used both as a store of value and medium of exchange for thousands of years.

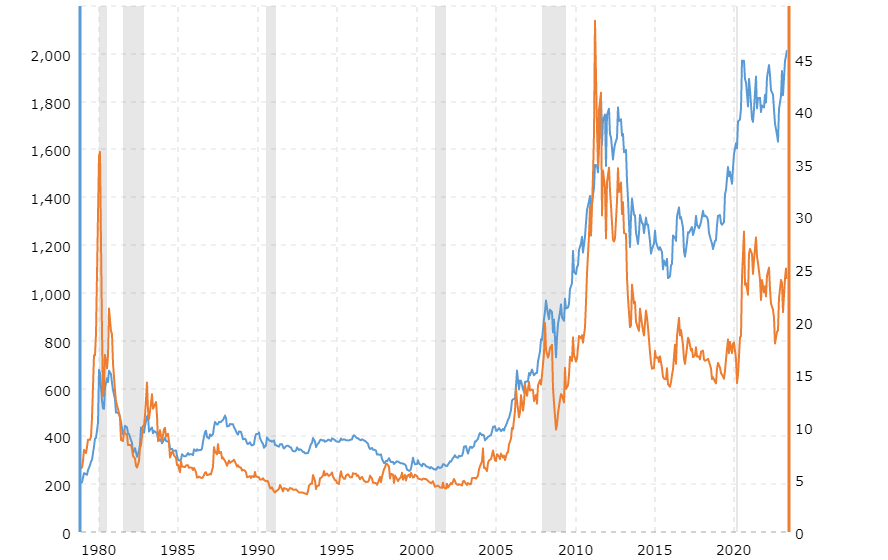

Gold is in Blue and on the left axis, Silver in Orange on the right axis. From the chart above, easy, softball question; has the value of Gold and Silver gone up in the past 40 years, or has the value of the USD declined? From the same source, MacroTrends, let’s have a look at the price of Gold and Silver since FDR attempted to confiscate all Gold from the citizenry in 1933, valuing it at $20 per ounce.

The price of Gold has gone up by a factor of 100 since 1933; what does that tell you about the value of the dollar relative to its value in 1933?

Real Estate is as the name implies, real. Let’s have a look at housing prices.

Between 1983 and 2023: Housing experienced an average inflation rate of 2.93% per year. This rate of change indicates significant inflation. In other words, housing costing $100,000 in the year 1983 would cost $317,378.22 in 2023 for an equivalent purchase.

The italics are mine. The cost of an equivalent purchase of housing has gone up by 3.17x in 40 years; that’s what they call a “hedge” against inflation and devaluation of the dollar.

I repeat myself, get out of dollars and into real assets as soon as you can; you can always convert one real asset into another at some later date.

It’s high time that the Federal Reserve was “cast into the fire.”

4 Hear this, O ye that swallow up the needy, even to make the poor of the land to fail,

5 Saying, When will the new moon be gone, that we may sell corn? and the sabbath, that we may set forth wheat, making the ephah <An ancient Hebrew unit of dry measure> small, and the shekel <a unit of value based on a shekel weight of gold or silver> great, and falsifying the balances by deceit?

6 That we may buy the poor for silver, and the needy for a pair of shoes; yea, and sell the refuse of the wheat?

7 The Lord hath sworn by the excellency of Jacob, Surely I will never forget any of their works.

Additional Reading:

https://www.bankrate.com/banking/savings/average-savings-interest-rates/

https://www.nytimes.com/2023/05/09/us/politics/us-debt-ceiling-x-date.html

https://www.huffpost.com/entry/the-war-on-savings-the-pa_b_9659798

Great information, hmmm fact based, fact checked, the Truth is out there. Thank you John. The way you break it down ensures the message is clear. More gold and silver please.